2025 Tax Brackets Joint Filing Jointly

Blog2025 Tax Brackets Joint Filing Jointly. For individuals, that rate kicks in at $626,350. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

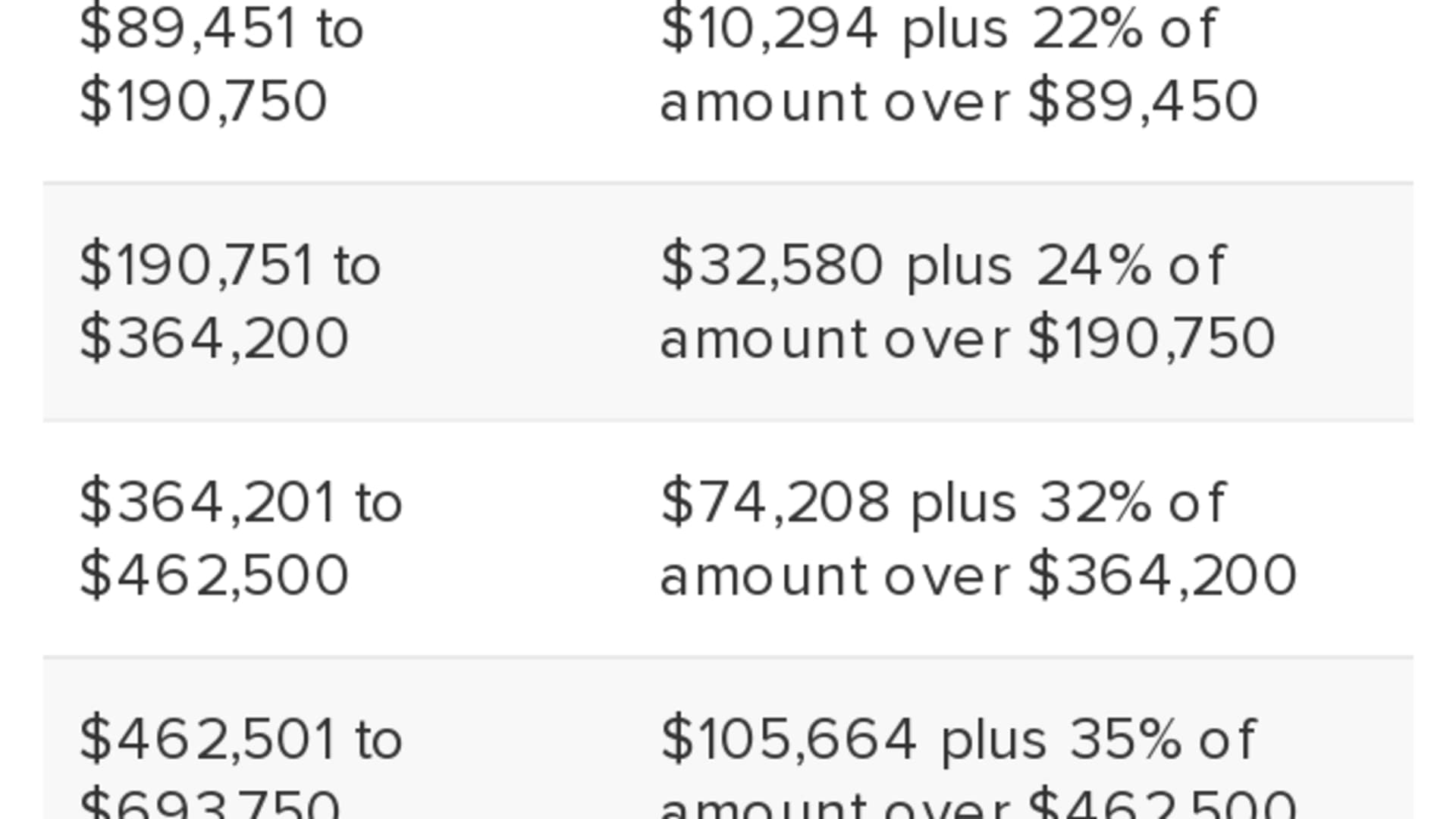

The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Then the next $71,000 or so will.

2025 Tax Brackets Announced What’s Different?, This can often result in a lower tax liability compared to.

2025 Tax Brackets Married Jointly Married Debby Brittani, Your bracket depends on your taxable income and filing status.

2025 Tax Brackets Taxed Right, Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.

Tax Bracket 2025 Married Filing Jointly In India Janel, Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.

Irs Tax Brackets 2025 Married Filing Jointly Norri Annmarie, Roughly the first $23,000 of that income will be taxed in the first bracket.

New Jersey 2025 Tax Brackets Married Jointly Bobbi Chrissy, For example, a married couple filing jointly will now be taxed at the top rate of 37% on income over $751,600.

Tax Brackets 2025 Married Jointly Over 65 Ardith Mozelle, Marginal tax rates won’t change in 2025.

Tax Brackets For 2025 Married Filing Jointly 2025 Katey Scarlet, In 2025, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1).

Tax Brackets 2025 Married Jointly New York Elvina Felisha, It is mainly intended for residents of the u.s.

Tax Brackets 2025 Married Filing Jointly Calculator Dolli Tallie, This can often result in a lower tax liability compared to.